Retirement by Design.

We design your personalized retirement plan from the ground up. Our blueprint will address risk, social security, income, taxes, and healthcare.

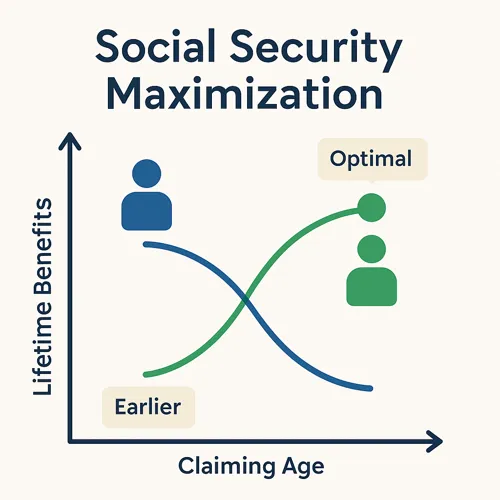

Social Security Maximization Report

📈 Social Security Maximization

We’ll help you choose the optimal time to claim benefits and avoid costly mistakes — especially when it comes to survivor income and spousal strategies.

Retirement Compass Income Strategy

💰 Income Planning

Turn your nest egg into dependable, predictable income. We use annuity analysis and smart withdrawal strategies to ensure your money lasts as long as you do.

Roth Conversion + Tax Efficiency Analysis

💸 Tax Efficiency

Today’s tax rates may be the lowest you’ll see in retirement. We’ll show you how to diversify your tax exposure with strategies like Roth conversions and smart withdrawal planning so you can keep more of what you’ve earned.

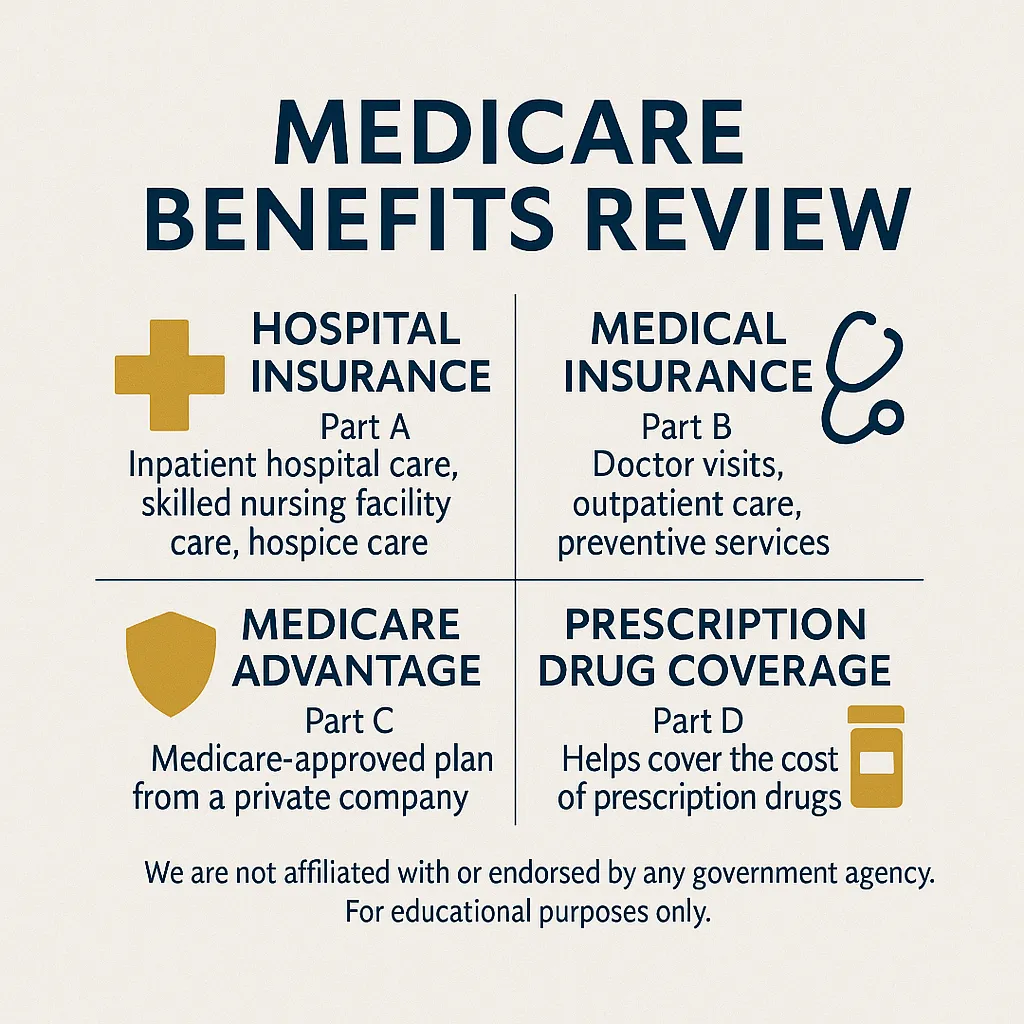

Annual Medicare & Prescription Plan Reviews

🏥 Healthcare Planning

Healthcare needs can change year to year — and so can your coverage options. From prescription changes and provider networks to shifting plan benefits, it's critical to stay aligned with the right coverage. We offer ongoing support to review your healthcare plans annually, ensuring they continue to meet your needs and protect both your health and your finances throughout retirement.

Testimonials

Jasmine R.

Started planning with Silver Maple and already seeing the benefits. The retirement and annuity plans are both personalized and reassuring. Definitely recommended for peace of mind.

Satisfied Client

Silver Maple’s team provided clear guidance and personalized advice, making retirement planning simple and reassuring.

Thomas K.

Silver Maple's investment management keeps me confident about my portfolio's growth and stability.

FAQs

Your Questions Answered: Navigating Retirement with Confidence.

Why choose Silver Maple Retirement Strategies for comprehensive retirement planning?

We specialize in tailored retirement strategies with a focus on long-term client relationships and personalized service.

Is there a cost for the initial consultation?

No there is no cost for a consultation.

Are there specific age requirements to start retirement planning with your agency?

It's never too early or too late to start planning for retirement. We advise starting as soon as possible, but we also welcome clients approaching or already in retirement.

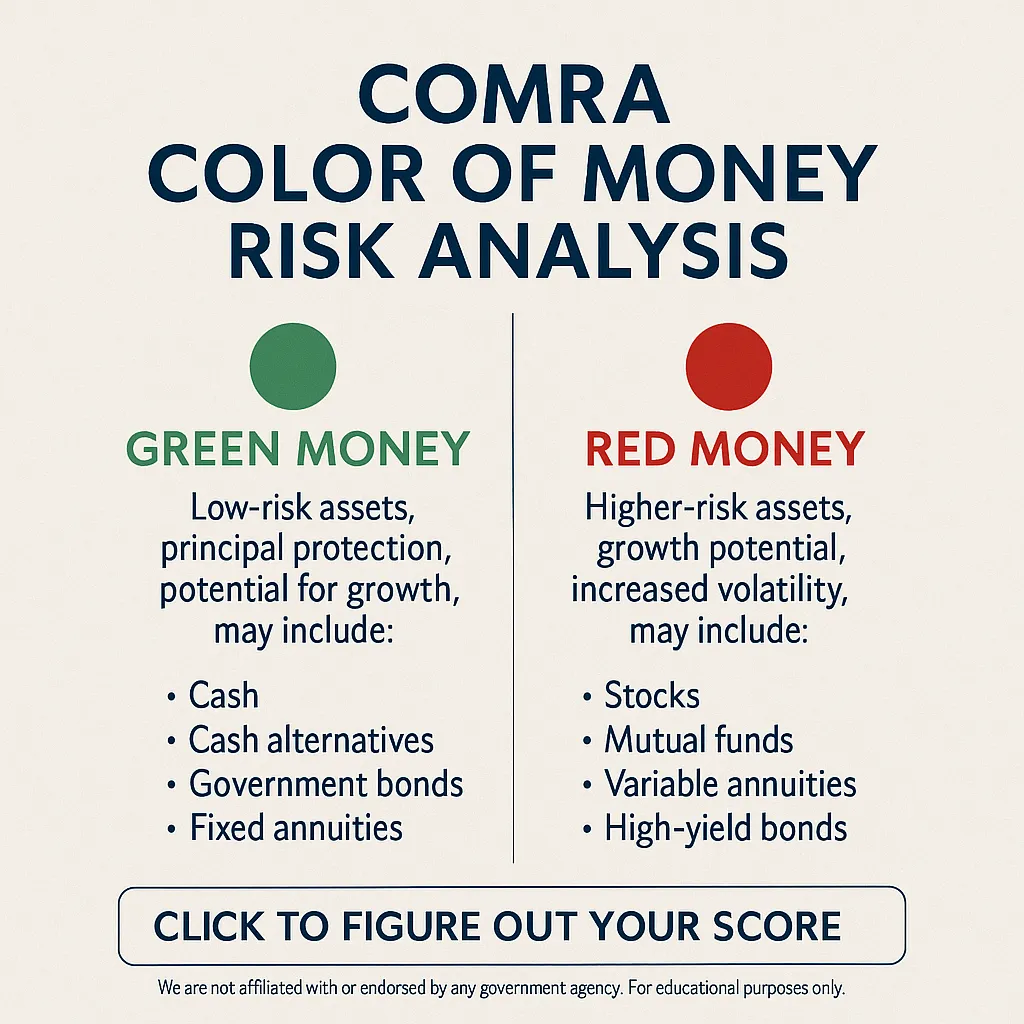

How do you manage investment risk to protect my retirement savings?

Investments carry market, interest rate, and credit risks. We aim to mitigate these through diversification.

Do you work with estate attorneys to ensure my plan complies with state laws?

Our team is knowledgeable in state-specific estate laws and works closely with legal experts to ensure your estate plan is compliant and meets your wishes

What should I bring to my first consultation?

Please bring recent tax returns, investment and retirement account statements, Social Security statements, insurance policies, estate planning documents, and any questions you may have. There is no cost for this initial meeting.

We help you design a retirement strategy that works in any economic climate by focusing on five core areas: identifying your financial comfort zone with a personalized risk analysis, optimizing your Social Security benefits to avoid costly mistakes, turning your savings into reliable income with annuity and withdrawal strategies, minimizing taxes through smart diversification and Roth planning, and preparing for rising healthcare costs with proactive coverage and long-term care planning.

© 2025 Silver Maple Retirement Strategies. Privacy Policy | Terms of Use